All About Depreciation For Small Businesses

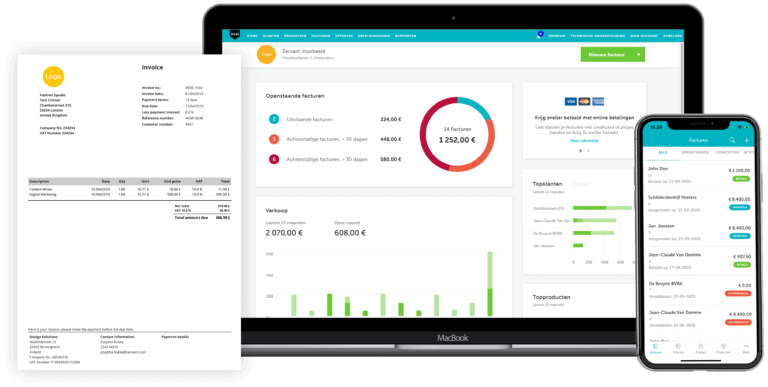

What is depreciation? Why does it matter? And how do you calculate it? If you’re a small business owner in the UK and have ever asked yourself any of these questions, look no further. Zervant, provider of fine online invoicing software, takes a look.

Table of Contents

What is Depreciation?

- Simply put, the decrease in value of an item over time.

- This happens as a result of routine wear and tear. And the fact that newer, improved versions come on the market.

- So a latest registration car will fetch a lot more than its ten year old counterpart. And the latest smartphone is worth more than an old handset with an aerial (same with cameras).

- In accounting it’s used to spread the cost of a fixed asset over its estimated, useful lifetime.

- Think of it as a way of measuring how much of an asset’s value has been used up. And also how much it has left.

Why is Depreciation Important?

Depreciation is important because:

- It spreads the cost of a fixed asset over time, and thus reduces its’ value on your balance sheet.

- It is recorded on your profit and loss statement. Your business uses part of a fixed asset’s value on a daily basis. For example when making sales or generating income.

- So depreciation helps match the cost of a fixed asset with the income it generates for your business.

Confused? Let’s look at an example:

- You buy a piece of machinery for £10,000.

- You expect it to be of use to your business for 10 years.

- This means that you will expense £1,000 in your accounts for the machine every fiscal year (£10,000 divided by the 10 year lifetime).

- This is an example of straight-line depreciation.

- This figure – £1,000 – can then be matched to the income the machine is expected to generate for the company in a particular fiscal year.

If you recorded the full price of a fixed asset in the financial year in which it was purchased, this would be misleading. That year would then have overly high expenses. And subsequent years would have artificially low expenses.

“Without using depreciation the long term benefits of an asset wouldn’t show up anywhere!”

What is the difference between Depreciation and Amortisation?

You might also come across the term amortisation. Both deal with the loss in value of a business’ capital assets over time. So what’s the difference?

- Depreciation is the term used when referring to tangible capital assets.

- These include, for example, computers, machinery, office furniture, vehicles, and so on.

- Amortisation is used when looking at the decrease in value, over time, of intangible assets.

- This covers patents, brand, internet domain names, trademarks, etc.

How to Calculate Depreciation?

There are 2 ways of calculating depreciation (both of which our free depreciation calculator can do for you).

1. Straight-Line Method

This method spreads the depreciation of an asset evenly across its’ estimated, useful lifetime. It assumes a constant, straight-line drop in value of the asset. It is calculated by dividing the initial cost of an asset by the number of years you estimate it will be of use to the company.

Here’s an Example of Straight-Line Method

- As above, let’s say a business buys a machine for £10,000.

- It is expected to be of use for 10 years.

- The business thinks it will be able to sell the machine for £1,000 after 10 years (the residual value).

- So to calculate straight-line depreciation subtract the residual value from the original value.

→ Here it is £10,000 minus £1,000 = £9,000.

- To work out an annual figure for depreciation divide this figure by the number of years the machine is expected to be of use:

→ In the example it is £9,000 divided by 10 = £900.

2. Reducing Balance Method

This method is seen by many people as the most appropriate way to calculate depreciation. It takes into account the fact that many assets depreciate quicker in the first few years, and then stabilise over time.

Think of when you buy a new car. The minute you drive it out of the showroom, the value drops instantly. But this drop becomes less significant as the years go by. And as long as the asset is in use, it will show on your business’ balance sheet.

Use this table to help explain Reducing Balance Method

In the example, a fixed asset was purchased for £10,000. It has an annual depreciation rate of 20%. The table shows the asset’s depreciation over a period of 5 years. And you can see what the residual value is – £3,277.

SOURCES- Pexels, StockSnap, Investopedia, e-conomic.