Better late than never? How late payments hurt small businesses

It can feel helpless to have to wait a long time for money that you’re owed. A successful business and professional life depends on you being paid on time and, whilst this isn’t something we think anyone should have to worry about, late payments are a reality for many entrepreneurs, small business owners and the self-employed.

Why are late payments on the rise, and how exactly do they impact small businesses?

Small and mid-sized enterprises (SMEs) are being asked to accept longer payment terms than before. And they have little power to fight back against their larger, more influential customers.

Table of Contents

Why do late payments occur?

There are a number of reasons (or excuses): the customer might be facing financial problems; they only pay when they feel like it; they may be disorganised; they may dispute your work as a stalling tactic; or they may be using their bigger size to dictate unfair terms and to optimise their cash flow, or they may have put you at the bottom of their list of priorities because you’re too passive in demanding payment and you have not made use of any late payment laws.

An expert in invoice processing, Esko Penttinen, Professor of Practice at Aalto University, told us how paper invoicing affects payments: “We did a case study on a large Finnish city and, simply by moving to electronic invoicing, this almost completely reduced the number of late payments to zero.”

He admits that sometimes late payments are due to the financial situation of the company, adding that, “Financially distressed companies may prioritise certain critical suppliers, which means that they pay the invoices that are necessary for the continuation of their business.”

How do late payments hurt small business?

Intrum Justitia’s report found that the small businesses are compelled into a vicious circle, as they receive late payments and, in turn, are themselves forced to pay their subcontractors late.

A European Commission report also found that small businesses are reluctant to exercise their legal rights out of fear of damaging commercial relationships.

Professor Penttinen explains that the damage from these late payments includes difficulties in making cash flow estimates and in making efficient use of cash. “This is detrimental, especially for smaller companies with limited financial means.”

Additionally, penalty fees for late payments also add up. “For example, the Finnish case study city had considerable annual costs associated with late payments (more than 100,000 euros per year),” explains Penttinen.

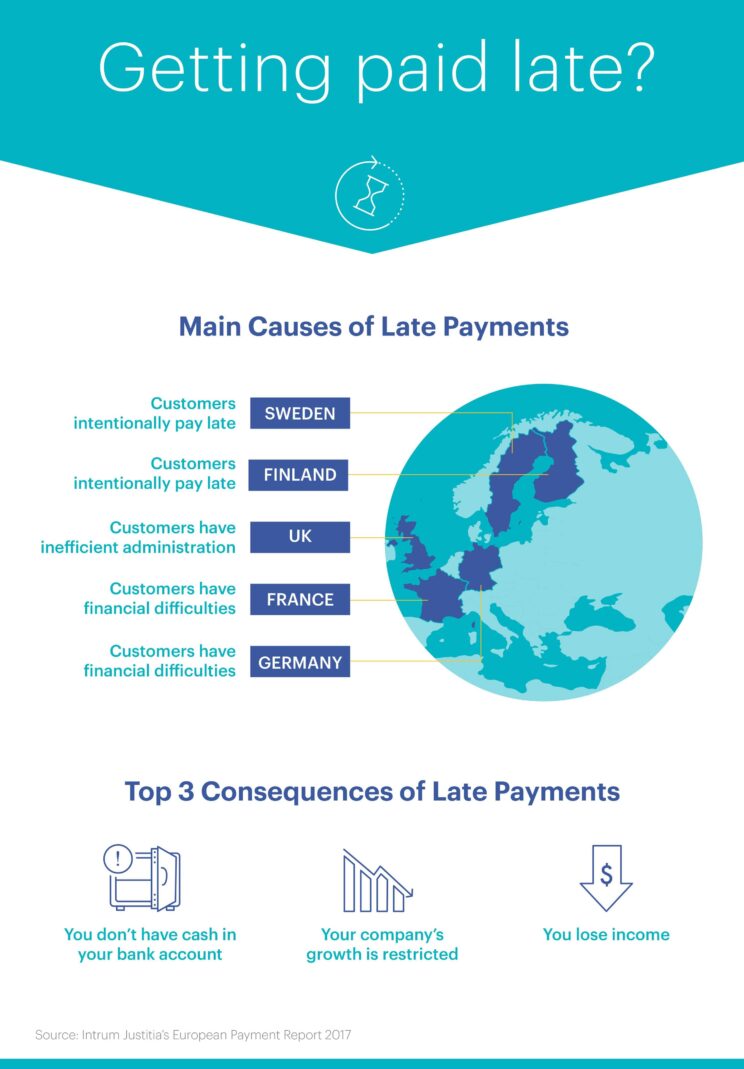

Are there differences across Europe?

While cultural differences between North and South Europe can be vast, Professor Penttinen believes the reasons for late payments, and consequences thereof, are fundamentally the same across Europe.

However, he argues that Nordic companies tackle the issue with more severity, with exceptionally short payment terms, typically just 14 days. Nordic companies usually follow those terms, adding that “Finnish companies want to abide by their contracts.”

The rest of the EU is more flexible, as the EU Late Payment Directive provides that 60 days should be the norm in B2B transactions. A few countries have gone further by setting maximum payment terms in their national laws: Germany with 30 days max, Spain at 60 days max, and France with 60 days, or 45 end-of-month max.

To help support Europe’s entrepreneurs and small businesses, Intrum’s CEO concluded, “We need new initiatives to establish a radically new culture of prompt payments.”

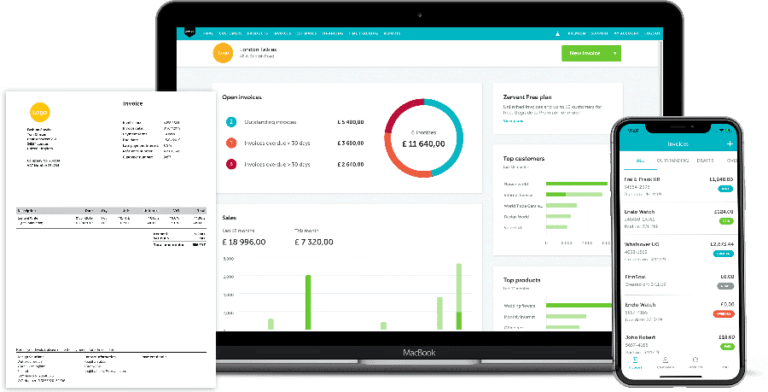

To help entrepreneurs monitor the status of their invoices in one simple overview, Zervant has developed a really easy tool to handle all invoicing. This way, it is easier for them to proactively identify issues in cash flow and take necessary measures to tackle these challenges.

Are you getting paid late?

Below we’ve compiled the main causes of Late Payments in the UK, Germany, Finland, France and Sweden. We also listed the top 3 consequences of Late Payments. Have a look!