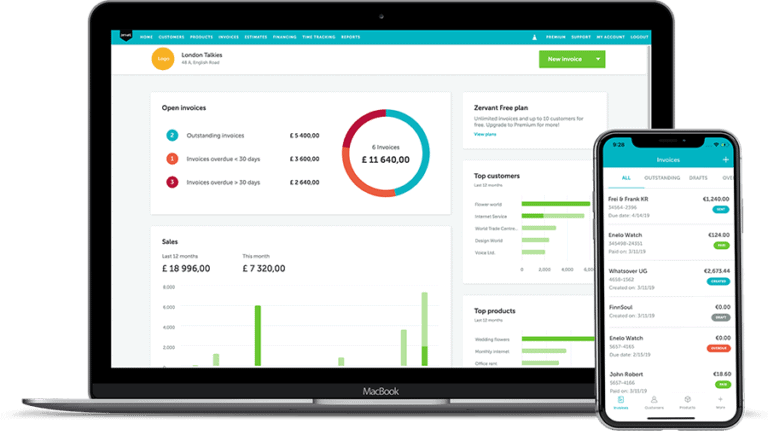

Simple, Powerful Invoicing

Start using Zervant for free and send your first invoice in under a minute

Create Free AccountFree Cash Flow Forecast Template

Controlling and forecasting cash flow is essential when you work for yourself. To help you keep an eye on this, we at Zervant made this free cash flow forecast template. Use it to monitor monthly balances, income, and expenses.

It’s ideal for sole traders, freelancers and small businesses in the UK.

Table of Contents

Cash Flow Forecast Template

Powerful, intuitive invoicing Create Free Account

Download: Excel

Powerful, intuitive invoicing

Download: Excel

If you find it comes in useful, be sure to check out the free tools section on our blog. We have everything you need – invoice templates, a mileage log, a stock take tool and more. They’re all 100% free!

Instructions for the Cash Flow Template

1. Getting Started

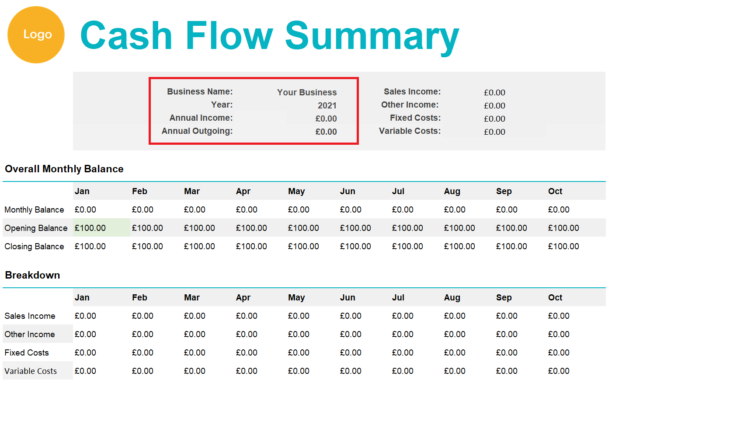

The first thing you need to do is add your company information, including name and the financial year you’re covering. You only need to do this once, at the top of the “Cash Flow Forecast” tab. The template will apply this information everywhere else for you.

We’ve highlighted these areas in red:

You also need to set the opening balance for your financial year. It can be £0, but you may have money from elsewhere you wish to transfer to the start of this year.

2. Adding Your Info in the Cash Flow Forecast tab

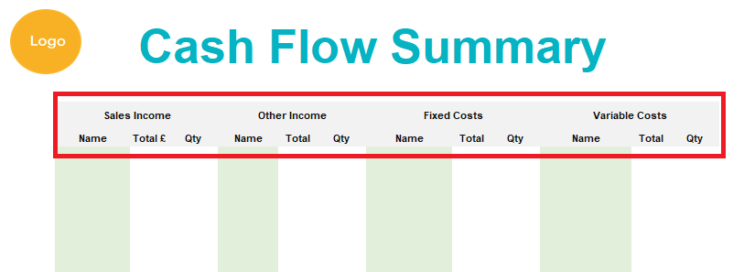

The “`Yearly Summary” tab is the main dashboard for your cash flow. The “Categories” tab contains columns for “Sales Income”, “Other Income”, “Fixed Costs” and “Variable Costs”, which should cover all the entries you need for a cash flow template. Use these tabs to track the daily movements of money in and out of your business and the areas in which you’re spending most.

Fill in the columns in green, the “Total” and “Qty” columns will automatically update to reflect a tally of these items from their entry into the monthly tabs.

This is the area we’re referring to highlighted in red:

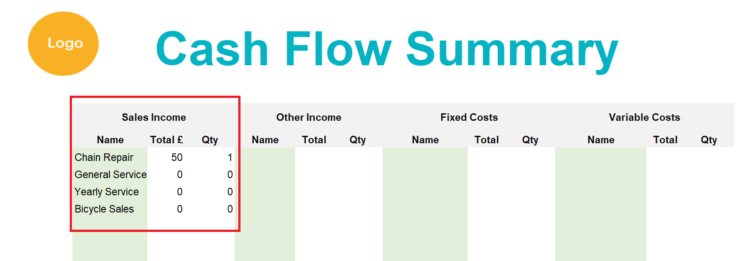

If you add the description of each item under “Name” and then select these items when creating the monthly cashflow accounts, the yearly “Total” and “Qty” columns will update to reflect the total number of entries. For example:

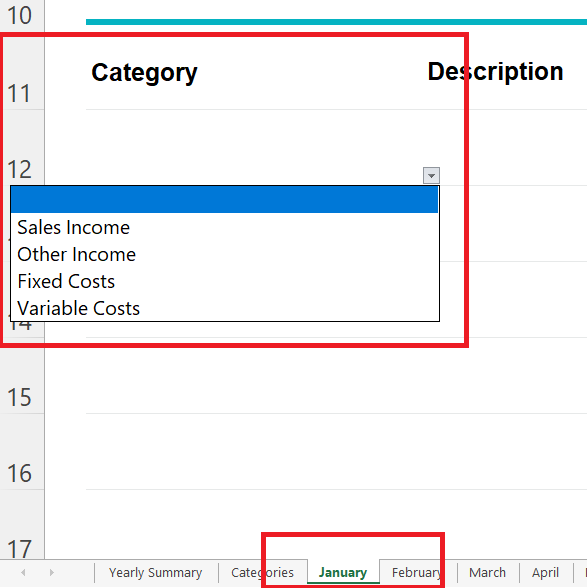

3. Making Entries

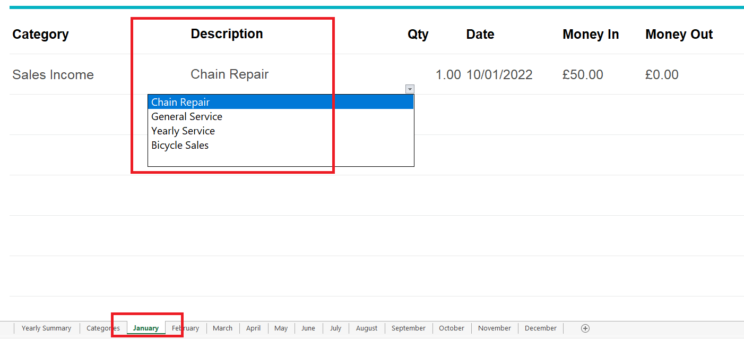

Categories will now appear in the drop-down menu for each of the specific tabs. This makes it easy for you to add daily entries in your cash flow template. All you need to do is add the date (dd/mm/yyyy format), the amount, and choose the relevant item from the drop-down menu (there’s an example in each of the tabs to show you).

In the picture below we’ve used the example of a bike shop to help explain things better. In the “Categories” tab we added different types of entries that might be used in a bike shop and then filled in the number of times these entries appeared within the monthly tabs:

The same principle applies for all four columns – “Sales Income”, “Other Income”, “Fixed Costs” and “Variable Costs”. All this information will automatically be updated on the main dashboard a.k.a. the “Yearly Summary” tab and on the “Categories” tab.

What Can I Use the Cash Flow Template For?

The cash flow template will help you keep an accurate record of the day-to-day flow of cash in and out of your business. Keeping track of things will ultimately allow you to save money – especially tracking tax-deductible expenses.

The Cash Flow Forecast tab will provide an overall view of how your business is performing. This includes monthly balances, opening and closing balances, and an overview of total income and expenses per month/ for the whole year.

Your monthly balance is the sum of all the transactions in a particular month eg. the “Income” and “Other Income”, minus the “Expenses” and “Capital Expenses” your business has.

The opening balance each month is the amount carried forward from the previous one, and the closing balance is the total of your opening balance and monthly balance in the month.